As war on this planet spreads like disease.

Our leaders don’t care and do as they please.

Stepping on any who may stand in their way.

Then bringing us closer to our judgment day.

We’re fertilized by the lies and hypocrisy.

And nurtured by blood we spill endlessly.

Life is a gift that we’ve taken for granted.

In the beds of dead roses we all have planted.

There’s times I’m awake and start to scream.

When I realize this nightmare isn’t a dream.

As I’m witnessing demons sitting on thrones.

Carved out of pieces of humanities bones.

So sometimes there’s anger in words I write.

My knuckles are white from holding on tight.

Watching the weak and the poor start to fall.

While remembering when it was one for all.

~~James Lagoksi

NWO is right around the corner...

Can your dog do this?

Keep eating that chicken!

For the retro gamers...

Must see-through TV...

First person Mario...

This is my rifle...this is my gun...

Lady Ga-ga-G.O.A.T?

We all wish we had Spielberg money...

Vitamin K...it does a body good...

A mouse sized kangaroo with rabbit ears...

Like sands through the hourglass...so are the PCs in our lives...

What does your name equal in the Qabalah?

Will you accept the mark of the Beast?

100 greatest paintings...

Carl Sagan does Old Spice...

Inception in 60 seconds...

Human-powered ornithopter would make da Vinci proud...

We also pollute in space...

From cosmism to deism...

Food magic...

And it burns, burns, burns, the ring of fire...

Ultimate cubicle prank...

Radiation projected...and again...and again...

URL Hunter...

Equinoxes explained...

The "real" axis of evil...

Speaking of evil...this guy is a toad...

Steampunk insects...

Well aren't you fucking lovely?

Now that is a bedroom!

History of science fiction...

The ring of firrrre... (props to Kc)

Keep fucking believing in that system!

The Day After the Dollar Crashes...

Eisenhower was telling the truth...50 years in advance!

Knowledge

The Museum of Online Museums

The Museum of Online Museums MoOM states that it has 'links from our archives to online collections and exhibits covering a vast array of interests and obsessions.' The visitor is invited to 'start with a review of classic art and architecture, and graduate to the study of mundane (and sometimes bizarre) objects elevated to art by their numbers, juxtaposition, or passion of the collector.' Organized into three sections 'The Museum Campus contains links to brick-and-mortar museums with an interesting online presence, 'The Permanent Collection displays links to exhibits of particular interest to design and advertising' and 'Galleries, Exhibition, and Shows, an ecelctic and ever-changing list of interesting links to collections and galleries' - you're sure to find 'where the good stuff is.' This site is an excellent portal to both famous and unknown museum and private collector sites; it demonstrates how the Internet can open museum doors to everyone!

The Museum of Online Museums MoOM states that it has 'links from our archives to online collections and exhibits covering a vast array of interests and obsessions.' The visitor is invited to 'start with a review of classic art and architecture, and graduate to the study of mundane (and sometimes bizarre) objects elevated to art by their numbers, juxtaposition, or passion of the collector.' Organized into three sections 'The Museum Campus contains links to brick-and-mortar museums with an interesting online presence, 'The Permanent Collection displays links to exhibits of particular interest to design and advertising' and 'Galleries, Exhibition, and Shows, an ecelctic and ever-changing list of interesting links to collections and galleries' - you're sure to find 'where the good stuff is.' This site is an excellent portal to both famous and unknown museum and private collector sites; it demonstrates how the Internet can open museum doors to everyone!

Insight

TEAMWORKComing together is a beginning; staying together is progress; working together is success.

Author unknown

Nothing great is ever accomplished by one person.

Sheryl Leach

Coping: With New Vegetarians

by George Ure

This'll sound like heresy, coming from the ETex outback within walking distance of one of the states largest private cattle ranches, but a reader note raises the issue, so we need to think about it now while we have time to react:

"Hi George;

I have been thinking about this the last couple of days - Cliff's last report talks about food poisoning that is made more known over the this year and into next year. Specifically I was thinking that the food poisoning might be radiation poisoning with cows milk, meat and crops in CA and the midwest.

Just a thought (not nice thought - but a thought).

What do you think?"

What!!!??? Obviously, you haven't read Peoplenomics #246, June 25, 2006, under the heading "The Coming Protein Cost Explosion" so let me to the piece fitting for you.

First, the start of the article:

You may not have considered becoming a vegetarian recently, but if my reading of the tea leaves is correct, there are several scenarios under which you might find protein becoming a luxury. I'm blessed coming from a Scottish and Danish ancestry because eating lots of protein and fairly high fat diets is what we were engineered for, especially on the Danish side of the family. Healthy hearts in spite of lots of real butter, whipping cream, and heavy gravies. My father's contribution was to stay in good shape and promote steak & eggs and a cup of strong coffee as the perfect way to prepare for a big test at school. These days, it looks like that kind of lifestyle is headed for extinction as three major forces are poised to combine and dramatically increase the price of protein over the next few years: The government's move to inventory every bit of livestock in America (NAIS), the soaring cost of agricultural inputs (feed, seed, diesel, and chemicals), and the serious issue of global protein depletion accentuated recent by the discussions of Bird Flu will probably all be involved ...

From there, I went on to question whether the National Animal Identification System - NAIS - which the government was pushing a while back as "voluntary"{ but then along came controls that were anything but voluntary.

So let's look at this part next, which was contributed by a Peoplenomics subscriber:

"The first is the 1/4 mile wide super highway due to start construction in 2007 extending from Mexico to Canada. The second is the need to nearly abolish private property [albeit along a continuum from some to all over a period of time] to establish the human exclusionary areas for the Wildlands Project. This exclusionary area would encompass nearly 90% of the total land mass of America. Sounds ultra fantastic doesn't it?

The Wildlands project is real. It is part and parcel of the [UN's] Agenda 21 and sustainability programs of the US government. This program IS currently being carried out bit by bit right under the nose of the American people. "

Going to fast for you?

Let's step back and see how the PTB/PTW will use the events of Japan to further promote the grab for control of the nation's food supply (this'll work just as effectively as though there had been a domestic nuclear or biological terrorist event...)...

- Like 9/11 the Japanese quake & nukes will be a huge "shock and awe" deal. If you can step back for just a moment, you can likely see this even in your own family.

- Next should come the "discovery" as our Aggieland contributed noted above) about potential for meat animals to suck up radiation and that we'll be told will somehow get into the foodchain.

- The SOLUTION, naturlich (German spelling, lol) will be to demand all animals destined for human markets to be what? INSPECTED!

- Thus, the NAIS program will get funding/legs under it...

- And the PTB will do their damn level best to convert a bunch of high protein consuming) omnivores into vegetarians.

- And then what? As the demand for ag land to raise meat animals falls (veggies are far more efficient carby sources, anyway) the once ag lands will be seized/rolled up into more wetlands and wild spaces which will be banked in Parks and Reserves.

So, when someone, like the reader this morning asks "What do you think?" I expect - like a Son of 9/11 event - the PTB will likely use this as a means of extending their levels of control and it wouldn't surprise me to see maybe even a bio-vector disease intro'ed about the same time, since while millions could die from radiation worldwide (depending on how bad things get) it could still be seen as a "clocking event" for a re-introduction of - wait, didn't someone mention this already today? - bird flu and claim it isn't flu - just that terrible radiation stuff.

---

Oh shit note: This article just popped this morning. There, bird flu just clicked a tumbler in the lock...

---

Funny how it could be spun if there really is an incredibly egotistical, anti-human group at the top of the world's socioeconomic pyramid.

Oh, wait! There is. If you don't realize that, then you probably haven't watched "The One Percent" a 2006 documentary about the ruling powers of the world in general, USApop in particular: It's good... "It was created by Jamie Johnson, an heir to the Johnson & Johnson fortune, and produced by Jamie Johnson and Nick Kurzon. The film's title refers to the top one percent of Americans in terms of wealth, who controlled 38% of the nation's wealth in 2001.[1]

The film premiered on April 29, 2006, at the Tribeca Film Festival. It was reported to have been purchased by HBO and a revised version of the film, substantially re-edited and incorporating footage shot since the 2006 festival screening, premiered on Thursday, February 21, 2008 at 6:30pm ET/PT on HBO's Cinemax.

It was stated in the Page Six column of the New York Post that Warren Buffett had written a letter to Nicole Buffett, daughter of his son Peter's ex-wife from another marriage. In response to her participation in the film, distancing himself from her, he wrote "I have not emotionally or legally adopted you as a grandchild, nor have the rest of my family adopted you as a niece or a cousin."

Oh, and if you have time to watch the documentary, and wish to go further in your researches, please visit his website and pass along our regards to Prof. G. William Domhoff at the University of California, Santa Cruz, who updated his studies of the concentration of wealth in America this year.

Sadly, to borrow a single data table from his "Wealth, Income, and Power" page here, the numbers keep concentrating more and more money/control in the hands of people - many of whom have not better credentials than being born right:

Let me put on my "good journalist hat" here and let me see if I can sum it up for you:

One camp will claim that capitalism if a miracle system which is adaptive to all kinds of exogenous shocks and that they alone are fit to rule over such a system and should therefore continue to exist in power because (they claim) it will benefit more people..

The other camp looks at the track record, non-movement in quality of life in linear proportion to effort and says something like "mo'fo'ing pricks are gonna find a way to bend us over again, aren't they?

Not sure which camp you're in, but let's go have a steak sandwich while we can and talk about it 'cuz the answer to which worldview represents, oh, 99% of regular humans(?) isn't really hard to figure out, is it?

---

By the way, Bill Gate's dad got high marks from us as we watched The One Percent (on Netflix) since he offered the reasonable view that estate taxes shouldn't be removed. Bill Gate's Sr. wrote Wealth and Our Commonwealth: Why America Should Tax Accumulated Fortunes which he coauthored with Chuck Collins, who I interviewed numerous times in my news-chasing days - very smart guy (although he'd remember me by my radio alias George Garrett, if at all...)

---

Which gets me to this: If I could leave more than 38¢ to each of my heirs, a steep estate tax of, oh, say 99% on any amount over $3-million per heir (exemption for genuine medical care cases with third party doc reviews) might actually move toward busting up the phat-cat club at the top. Zero tax below that, 99% tax above.

So look for events go: Radiation > government monitoring > health risk discovery > reform of food sources > some die-off > continued accretion of wealth by the aristocracy.

The arrogance, conceit, inhumanity, and raw power of the top 1% ought to be evident in their "plumage" soon enough.

Still got steak sauce on the shopping list?

| The Giant American Banking Deception | |

| Published on 03-13-2011 | |

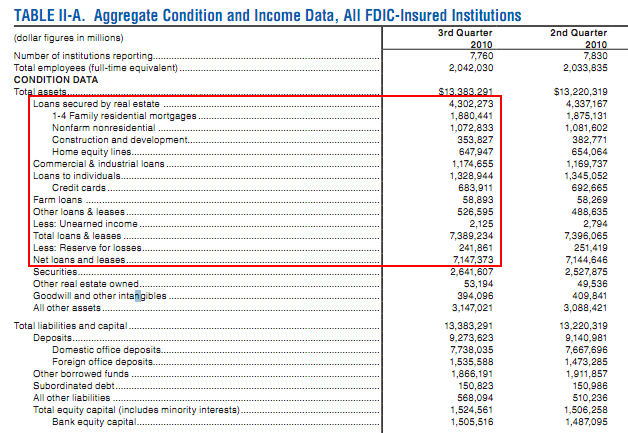

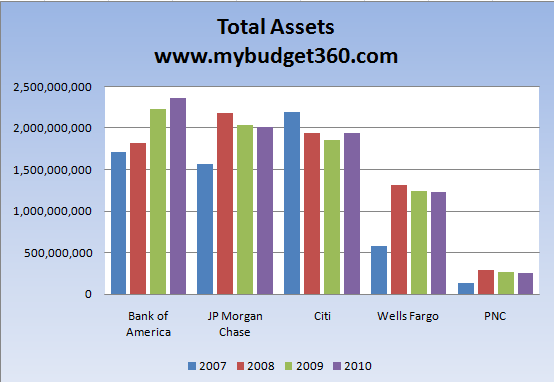

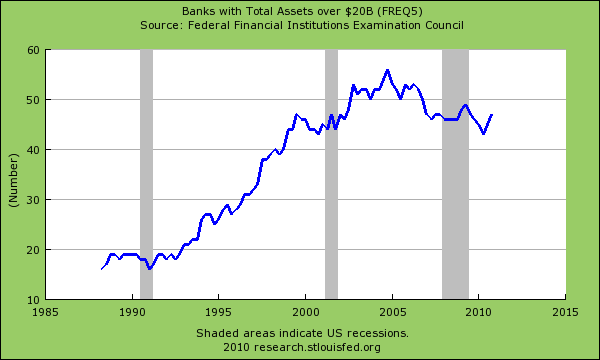

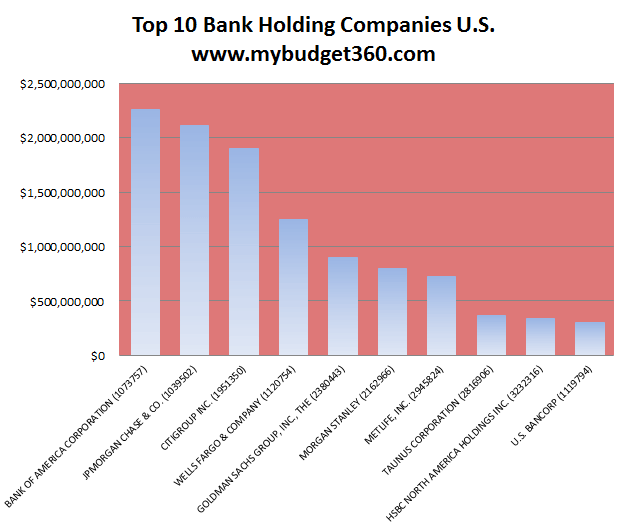

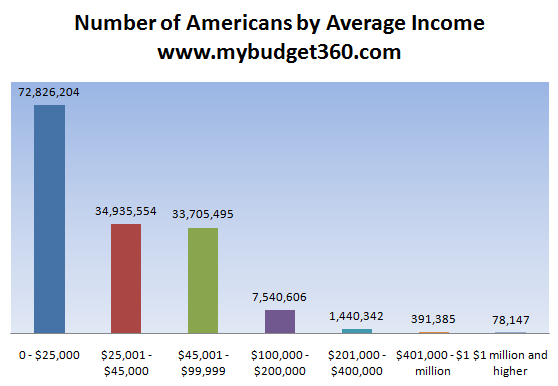

Source: My Budget 360 The American banking industry is trying to convince the public that simply by hiding bad debts in the deep levels of corporate balance sheets that taking on leveraged risk is somehow safe. FDIC insured banks currently have $7.4 trillion in actual deposits, much of it covered by the Deposit Insurance Fund (DIF). Most Americans think that there is a “fund” similar to the“Social Security Trust Fund” to protect their hard earned savings but in reality the DIF is empty. The DIF is running on fumes and inspiration. Banks are trying to fool the public that somehow the Fed and FDIC backed institutions largely of the too big to fail variety, can simply print or hope money into existence like wishing mules would turn into magical unicorns. Most understand even at an instinctual level that something is wrong here. Even the king of the Ponzi scheme Bernard Madoff called the current structure the biggest of Ponzi schemes. He should know. Too big to fail get bigger  Source: Individual 10-Ks In September of 2008 when the financial sector was melting down like cheese on a microwavable quesadilla, the banking sector asked for $700billion because many banks grew “too big to fail” and would cause systemic risk. In other words the financial system was screwed. There was no doubt that the reason for the Great Recession was too big to fail. So you would logically conclude that the solution would be to wind down these mega institutions so we wouldn’t have this problem down theroad. Instead as the above chart demonstrates, the U.S. Treasury and Federal Reserve, largely staffed with former Wall Street bankers created even bigger firms. Too big to fail became too damn big to fail. The growth of mega banks has been going on for three decades:  Mega banks peaked in 2005 but what the chart doesn’t show is that now we have fewer banks with more assets. These banks which hold many of your checking accounts, mortgages, savings accounts, and credit cards are largely leveraging the hard earned money of average Americans and speculating in global stock markets. Since Glass-Steagall was repealed in the late 1990s commercial and investment banking have been operating under one roof. This sinister wedding has allowed banks to use once boring and mundane investments (i.e., mortgages) and has allowed them to turn them into casino like instruments (i.e., mortgage backed securities). You can bet on mortgages just like you can bet on the next Manny Pacquio fight. Banks overstating assets Source: FDIC U.S. banks have over $13.3 trillion in assets. This might sound impressivebut just think of how many junk loans brought on by the housing crisis arestill sitting on bank balance sheet as assets at over inflated levels. Banks still claim over $3 trillion in commercial real estate loans at incredibly inflated levels including empty dusty shopping centers, hotels with no customers, and parking lots that serve only one customer of the tumbleweed variety. This is what a bank can claim as an asset. Remember, bank deposits in cold hard cash are actual liabilities. They have to pay this back obviously. Yet the $7.4 trillion in actual deposits allows banks to leverage this money because of fractional reserve requirements and speculate in global stock markets like hitting the roulette wheel. That is why investment banks like Bear Stearns and Lehman Brothers even with no customer deposits were able to leverage their institutions 30-to-1. A small 3 to 5 percent decline was enough to collapse both institutions and it did. Most of the assets concentrated in a few hands  Even though there are over 7,500 banks backed by the FDIC thelarge concentration of the $13 trillion in assets is centered with the top 10 banks. Bank of America and JP Morgan Chase alone each hold more than $2 trillion in assets each. Bank of America just announced it would be splitting $1 trillion in “legacy loans” into a bad bank model. This is like you splitting your household in two and putting all the bad loans you have into a bad bank and simply ignoring it when it comes to figuring out your net worth. The too big to fail banks still dominate the market. Keep in mind that all the deposits at these banks are backed by the FDIC DIF that is completely insolvent. No money is there. The system is being held up purely on faith and the Fed is trying to digitally print money to devalue the U.S. dollar so our debts can become cheaper. Of course most Americans don’t have the debt that many of these financial institutions have. In many cases if you can’t pay your debts you lose your home through foreclosure or have to file for bankruptcy. Banks can reach into the taxpayer wallet and take money while pushing the cost to later generations. This is how the current system is structured. Take money now to pay out current debts (i.e., a Ponzi scheme). In the meantime the average income of individual Americans is lower than you think:  Source: Social Security 72,000,000+ Americans (over half) earn $25,000 or less a year. Another 34,000,000+ earn between $25,000 and $45,000. The notion that everyone is feeling the pain of this recession equally is completely deceptive. Working and middle class Americans are feeling the brunt of this recession. You would think that after the worst crisis since the Great Depression things would be different today in Q1 of 2011. Yet nothing has changed and in fact, we have invigorated the too big to fail with our current government policies. This is a government built by Wall Street banks and for Wall Street banks. Don’t be surprised when the next crisis hits because nothing has changed. | |

Today's Quotes

PREPARATION"The secret of success in life is for a man to be ready for his opportunity when it comes." -- Benjamin Disraeli

"The ideal attitude is to be physically loose and mentally tight." -- Arthur Ashe

"You cannot speak that which you do not know. You cannot share that which you do not feel. You cannot translate that which you do not have. And you cannot give that which you do not possess. To give it and to share it, and for it to be effective, you first need to have it. Good communication starts with good preparation." -- Jim Rohn

"Practice is the price of mastery. Whatever you practice over and over again becomes a new habit of thought and performance." -- Brian Tracy

Peace, love, and happiness...until next time...